ITI Limited: Company Overview, Financial Analysis, and Investment Insights

ITI Limited: Overview

ITI Limited specializes in manufacturing, trading, and servicing telecommunication equipment, along with offering associated and ancillary services. Its primary revenue streams include turnkey projects (78%), service offerings (19%), and manufacturing/trading (3%). Major projects under the turnkey segment include BharatNet, ASCON, and e-governance initiatives, with notable clients such as BSNL, MTNL, and Indian Defense Services. The company’s service offerings encompass contract manufacturing, equipment testing, and IT solutions, while its product range includes energy meters, rugged telephones for defense, Wi-Fi equipment, and solar panels. ITI maintains strong ties with government agencies, PSUs, and state governments, which accounted for 76% of its FY20 revenues. With an order book of ₹12,000 crores, including BharatNet Phase 2 and ASCON Phase 4, the company is executing large-scale projects worth ₹4,800 crores and₹7,800 crores, respectively. Backed by a ₹4,150 crore government-approved revival plan, ITI has received substantial equity and grants to support its operations and new projects.

Latest Stock News (6 Jan 2025)

Past two trading sessions the stock surged with upper circuit with high volumes showed a great signs earlier but on January 07, 2025 stock suddenly hit the lower circuit of 10%, sensing the quick profit booking and a case of pump and dump situation creating a panic situation for investors and worrying about the stock’s future. But, the company clarified to public that there was no manipulation from their side and it random abnormal trade happened in stock.

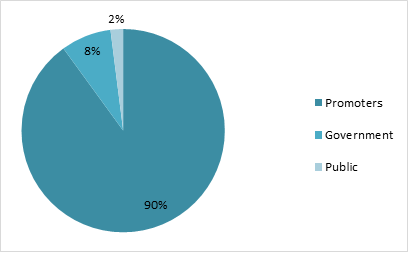

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹47048 Crore |

| Revenue | ₹2396 Crore |

| Profit | ₹-474 Crore |

| ROCE | -8.43% |

| P/E | – |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| ITI Ltd | 47048 | 2396 | -474 | -8.43% | 0.13 | -258 | 1.07 | – |

| Astra Microwave | 7454 | 969 | 130 | 18.7% | 0.72 | 32.03 | 0.31 | 57.1 |

| Avantel | 3655 | 229 | 62 | 47.5% | 1.19 | 38.3 | 0.08 | 59.3 |

| BEML Ltd | 15959 | 4054 | 286 | 15.25% | 0.76 | 32.9 | 0.24 | 55.9 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 2059 | 2362 | 1861 | 1395 | 1264 |

| Expenses | 1914 | 2313 | 1753 | 1549 | 1582 |

| EBITDA | 144 | 50 | 107 | -154 | -318 |

| OPM | 7% | 2% | 6% | -11% | -25% |

| Other Income | 184 | 161 | 255 | 53 | 43 |

| Net Profit | 146 | 9 | 119 | -360 | -569 |

| NPM | 7.1% | 0.4% | 6.4% | -25.8% | -45.0% |

| EPS | 1.58 | 0.1 | 1.27 | -3.79 | -5.92 |

Stock Price Analysis

In terms of performance, ITI has shown a return of -9.99% in one day, 33.15% over the past month, and 109.49% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹210.2 and a high of ₹548.7. The stock has experienced fluctuations today, with a low of ₹491.25 and a high of ₹592.85, The volatility is very high in this month which has also raised suspicion on company’s management for stock price manipulation, but is resolved now by the company.